Bitcoin : L’actif que votre conseiller en gestion de patrimoine ne mentionne pas (mais devrait)

ETF Bitcoin : La promesse d'une richesse... sans souveraineté

Bitcoin is primarily a digital store of value, often compared to digital gold. Its most important characteristic for long-term savings is its absolute scarcity. There will never be more than 21 million bitcoins, a principle embedded in its code.

Unlike traditional currencies (euros, dollars) that can be printed at will (leading to inflation and diminishing purchasing power), the supply of Bitcoin is fixed and predictable. This programmed scarcity makes it a powerful tool for protecting wealth against long-term inflation.

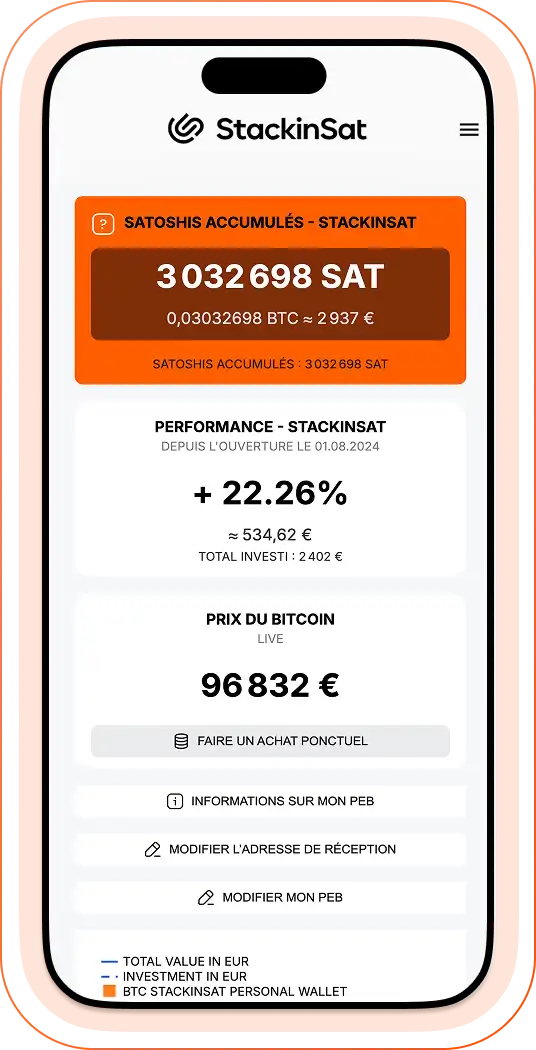

Bitcoin has become a digital asset and a store of value, which continues its expansion worldwide. With StackinSat, our goal is to democratize access to Bitcoin, by facilitating savings and investment.

Investing in Bitcoin serves several purposes :

Protecting against inflation : Its programmed scarcity makes it a potential store of value against the devaluation of fiat currencies (such as the euro or the dollar).

Aiming for high performance : As a young and innovative asset, Bitcoin offers significant growth potential over the long term, although this comes with notable volatility.

Achieving financial sovereignty : Owning your own bitcoins means having full control over your wealth, without relying on a trusted third party.

The simplest way to invest gradually is through our Bitcoin Savings Plan.

DCA, or Dollar Cost Averaging, is a simple yet powerful investment strategy, ideal for long-term savings: programmed investing.

Rather than investing a large sum all at once in an attempt to guess the "right moment," DCA involves investing a fixed amount at regular intervals (weekly, monthly, etc.), regardless of market fluctuations.

Yes, DCA is a strategy particularly well-suited to Bitcoin, precisely because its price is volatile and unpredictable. This method turns market uncertainty into a strategic advantage.

It smooths your average purchase price by automatically adapting to market cycles:

In a bear market, where prices are falling, your fixed investment of €100 allows you to buy more and more bitcoins with each new purchase. You therefore accumulate a larger quantity of assets at an increasingly lower average cost, which is ideal for maximizing your potential gains during the future rebound.

In a bull market, conversely, in a bull market, where prices are rising, your €100 will buy fewer bitcoins, but the value of your portfolio increases thanks to your previous purchases made at low prices. This allows you to continue investing without risking placing a large sum just before a correction.

In short, DCA relieves you of the stress of having to predict market movements. It is a disciplined approach that reduces risk and allows you to build a solid position over the long term, regardless of the conditions.

Yes, the purchase and holding of Bitcoin are perfectly legal in France. Bitcoin is considered a "digital asset" by the state. Capital gains realized upon resale in euros are subject to taxation (the Single Flat Rate Withholding Tax, or "flat tax").

StackinSat is a French company registered as a Digital Asset Service Provider (PSAN) with the Financial Markets Authority (AMF), ensuring a legal and secure framework for you. For more information, please visit the About StackinSat page.

Past performance does not guarantee future results. However, the DCA strategy on Bitcoin has historically performed very well over various time horizons.

Over 5 years and 3 years : These longer periods have shown very significant gains. They smooth out market cycles by taking advantage of downturns to accumulate more BTC at good prices, maximizing returns during bull markets.

Over 1 year : Performance is more variable and depends on recent trends. The benefit of DCA remains the same: to reduce the risk of a bad entry point and build a disciplined position.

The exact figures change every day, so it's best to see for yourself.

Try our DCA simulator and discover the exact result over these periods!

The high volatility of Bitcoin can be frightening, but it is not an obstacle to regular savings if you adopt the right strategy. The solution is DCA (Dollar Cost Averaging).

By investing a fixed amount at regular intervals (for example, every month), you automatically buy more Bitcoin when its price is low, and less when it is high. This simple and disciplined method smooths your average purchase cost and turns volatility into a real accumulation opportunity.

With a time horizon of several years, Bitcoin's historical performance tends to outperform its short-term volatility. DCA makes Bitcoin perfectly compatible with progressive savings by reducing the risk and stress associated with its price fluctuations.

Nothing could be simpler. Set up your savings plan in a few minutes, and StackinSat takes care of the rest.

Create an account